Whenever you catch an episode of shows such as ‘Homes Under The Hammer’, it’s easy to assume that the costs of becoming a landlord only extends to the purchase price of the property. In reality, property ownership is a huge responsibility not least when you intend on allowing others to live there. All of which adds additional cost depending on the individual circumstances of each landlord.

Being aware of what costs you could be liable for will get your landlord experience off to the best start. It will also help you make the best property purchase decision since you’ll need to make sure your costs are covered by your total yield once all of the associated costs have been deducted.

Here are some of the main costs of being a landlord to guide you.

Mandatory Costs

There are some costs you absolutely cannot skip on since they are a legal requirement as a landlord. Not only would the fines for not doing so far outweigh any initial costs, but you could get a criminal record or even be sent to prison in the most serious cases.

Not having the correct documentation may also prevent you from being able to let your property with a lettings agency, since they will check such details are in place.

Energy Performance Certificate:

Cost: £65 every 10 years

Also known as an EPC, an energy performance certificate will indicate how energy efficient the property is. While it’s only required every 10 years, you may wish to have it repeated sooner if you’ve made significant upgrades to the thermal efficiency of the property (i.e new windows, cavity insulation, roof insulation etc), since it’s beneficial to have the changes reflected in the report.

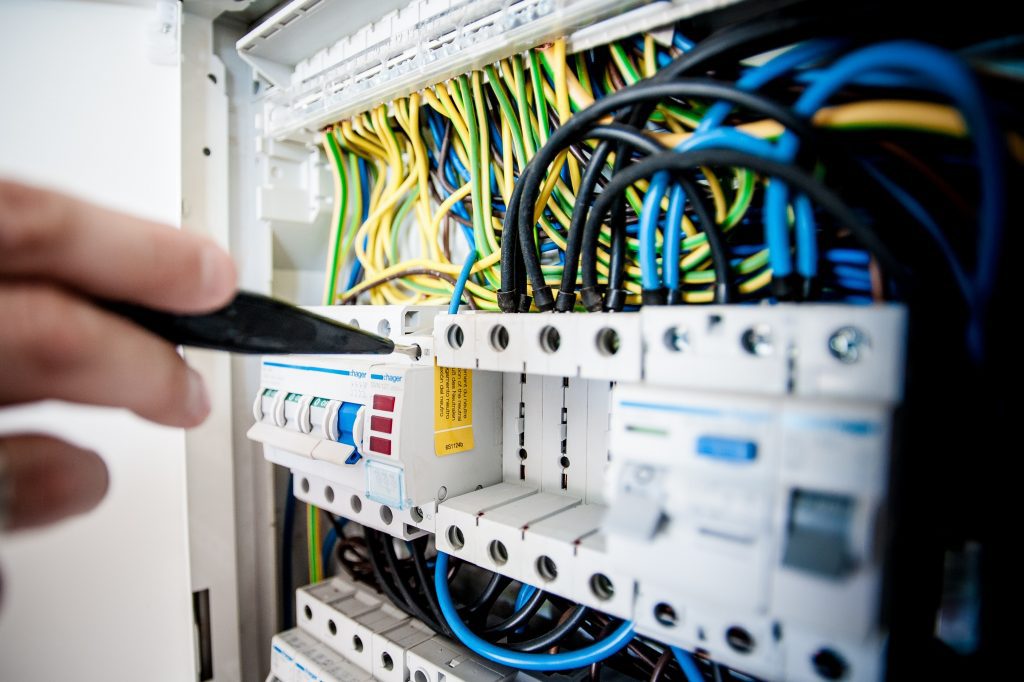

Electrical Safety Inspection/Report:

Cost: £199 every 5 years

In July 2020 it became mandatory to undertake an Electrical Installation Condition Report’ (EICR). All landlords must carry this out on their properties even if it’s an existing let. It can be a serious fire risk if your electrics are outdated or have been installed incorrectly, so they will need to be thoroughly checked.

Gas Safety Certificate:

Cost: £45 per year

Similar to an EICR, your gas safety certificate is also a legal requirement and must be renewed every year. Once everything has been found to be in good working order, you’ll be issued with a certificate that covers you for the next 12 months until your next renewal is due.

Smoke & Carbon Monoxide alarms:

Cost: £30 per property

Ensuring your property has working smoke and carbon monoxide alarms is essential. If the tenants are deaf or hard of hearing, then you should install specifically adapted smoke and carbon monoxide alarms so that they are alerted promptly.

Income Tax:

Cost: Depending on total income

Being a landlord is considered an income just the same as any other job. It’s worth hiring an accountant if you are unfamiliar with filling out a tax return as a landlord since it can get quite complicated the more properties you own. The rate of tax you will be charged will be dependent on your tax threshold, with basic taxpayers paying 20% tax, rising to 45% for those in the highest bracket who earn over £150,000 a year.

Admin Costs

Being a landlord comes with its fair share of paperwork. These are some of the associated admin costs you may have to pay for.

Landlord License:

Cost: £500 every 5 years (if applicable)

Every local council has its own rules surrounding landlord licences, in that some require them and others don’t. If your local council does require a landlord licence, the typical cost is £500.

Landlord Insurance:

Cost: £150 per year

Landlord insurance isn’t a legal requirement but is strongly recommended since the price pales in comparison to the cost of repairing or rebuilding your property if the structure is damaged or destroyed. Also, most mortgage providers will not accept your application unless landlord insurance is in place.

An add on you might want to consider is tenant default insurance, which will cover the cost of missed rent payments if your tenants fail to pay.

Letting Agent Management Fees:

Cost: Typically 8%-14% of rental income

When you let out a property you can either take on the responsibility entirely yourself or enlist the help of a lettings agency. To help make your decision, remember that letting out a property requires a lot of time and effort. If you currently work full time or have a very busy lifestyle, you need to make time to fulfil all of your responsibilities as a landlord, manage tenants not to mention acquire them in the first place.

People choose a lettings agency for the expertise and efficiency this can provide. The process starts with finding the right tenants for your investment since this will have a huge impact on your overall experience as a landlord. Seen as people naturally head to a letting agency to view available properties, this instantly pools a wider clientele versus going it alone. Every step after this from setting up a tenancy to managing all of the administration will be diligently handled.

ICO Registration:

Cost: £40 per year

ICO stands for the Information Commissioner’s Office. Registration is required with the ICO for anyone who handles any personal information due to GDPR. It’s something that catches a lot of landlords out, especially those who don’t have a lettings agency on their side to inform them of such changes to the law. The ICO can take enforcement action against anyone eligible who doesn’t register.

Maintenance And Repairs

The property needs to be in good working order so that it complies with health and safety regulations. Also, maintenance issues may crop up such as a faulty appliance, burst pipe or loose roof tile which has led to a leak in the ceiling. There are hundreds of potential issues which can occur, and these are far more likely to happen if the property hasn’t been given the right TLC before being let out.

Some repair costs may be covered under insurance. Just beware that your approach to fixing such issues will make or break your reputation as a landlord, seen as the property is someone’s home. Therefore, to maintain a good tenant-landlord relationship, any such issues must be sorted promptly.

With period in properties, in particular, maintenance issues are likely to be due to wear and tear. Aspects such as roofing, guttering, insulation, windows and drainage may require inspection, repair or replacement.

Also before purchasing a property, ensure it does not contain any asbestos, since this was a commonly used building material until the late 1990s in the UK. Asbestos can be very costly to remove and make safe.

To Sum Up

The above is just a snapshot of some of the main costs associated with being a landlord. If you’re a Nottingham based landlord we’re here to help you every step of the way. If you need any help or advice on anything we’ve mentioned above, then you’re in the right place.

Give us a call on 0115 958 7791 to speak to our friendly team. We’re the leading letting agents for the Nottingham area, so you can be sure our team can help.

If you’re looking for more tips and tricks, take a look at our other landlord guides and blog posts!